description

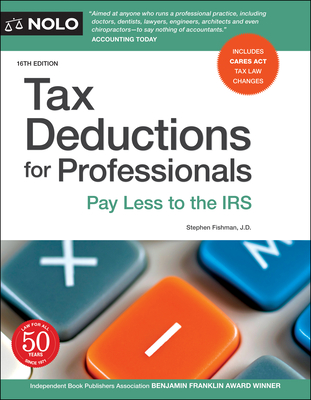

7Professionals are entitled to lots of tax deductions which can save them lots of money-if they take advantage of them. There are also key tax advantages related to business entity choice for professionals under the tax laws. This book explains everything professionals need to know to make sure they understand the best business entity choice for them and all the deductions they are entitled to take, including new and important deductions and tax benefits under the CARES Act. The book is organized into practical, easy-to-understand categories of the most commonly-used business deductions. It includes lots of interesting and relevant examples so readers can see how the deductions work and the context they come up in. It covers start-up expenses, the 20% pass-through deduction, health care costs, continuing education, professional fees, home office, and more.

member goods

No member items were found under this heading.

Return Policy

All sales are final

Shipping

No special shipping considerations available.

Shipping fees determined at checkout.