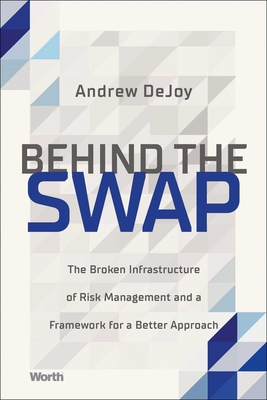

Dejoy, Andrew

product information

description

wap examines the risks involved in post-trade processing in swaps and derivative markets, and provides solutions to better control those risks. While Andrew doesn't claim to have all the answers, he does believe there is a way to create a safer, stronger, and better financial system for all stakeholders. In August of 2020, Citibank made one of the worst mistakes in banking history: it accidently sent out almost $900 million of its own funds. Many of the recipients didn't give back the money. Citibank sued. And a federal court ruled that the recipients could keep the funds. Citibank's error is not surprising. The underlying contributors that led to the mistaken payment permeate the global financial services industry. Manual data entry, decades old technological infrastructure, inadequate training, and systems that can't interact with one another are just a few of the problems that face post-trade processing--the machinery behind financial markets. Unfortunately, years of neglect by regulators and financial institutions themselves has left this infrastructure needlessly complex, astoundingly inefficient, frequently inaccurate, and woefully inadequate for modern financial markets. Behind the Swap helps explain what's driving the recent series of banking blunders like Barclay's $678 million clerical error, and Citibank's fat-finger Flash Crash that caused an 8% decline in the Swedish stock market. The book also touches on concepts that readily connect to Credit Suisse's $5.5 billion loss on its trades with Archegos. The problems are easy to see but difficult to admit. For financial institutions, the current system costs billions of dollars each year in labor, systems maintenance, and lost funds. For regulators, the current system precludes the ability to track systemic risk. It also artificially inflates the stability of the global financial system. For lawyers and prosecutors, the current system allows ample opportunity for unlawful misconduct such as rogue trading and fraud.

member goods

No member items were found under this heading.

notems store

American Patriots Presents Ron DeSantis: ...

by Publishing, American Patriots

Paperback /Paperback$10.49

listens & views

SWAMP DOGG PRESENTS MR T ...

by TURRENTINE,STANLEY / BLAKEY,ART / JAZZ MESSENGERS

COMPACT DISC$15.99

Return Policy

All sales are final

Shipping

No special shipping considerations available.

Shipping fees determined at checkout.