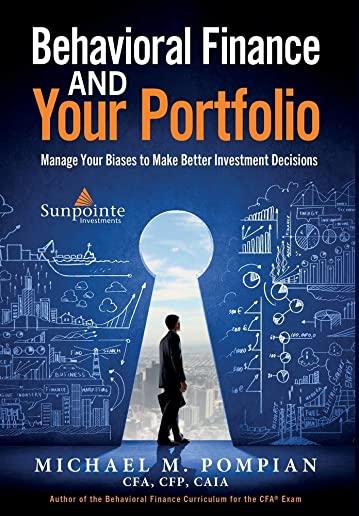

Pompian, Michael M.

Since his first book Behavioral Finance and Wealth Management was written during the internet stock bubble period of the late 1990's, the investing world has undergone some significant changes. In 20 years, there have been three tumultuous bear markets in 2000, 2008 and 2020. At the same time investor behavior hasn't changed in terms of making irrational decisions with their portfolios especially during times of market upheaval.

Pompian understands the behavioral biases that investors have through a 25-year career working with advisory clients. Through this extensive experience, he has discovered specific ways to help investors work through their biases to make better investment decisions. In Behavioral Finance and Your Portfolio.

Divided into six comprehensive parts, this guide opens with an introduction to the basics of behavioral finance, focusing on the aspects most relevant to individual investors. From here, Parts Two (Belief Perseverance Biases), Three (Information Processing Biases), and Four (Emotional Biases) define and illustrate a total of twenty of the most important biases-within the cognitive-emotional framework. After covering the foundations of behavioral finance, the biases, Part Five turns to the main focus of this book: practical application of behavioral finance for investor portfolios. This section reviews the four behavioral investors types (BITS), the investment biases associated with each one, and then takes the concepts presented and applies them in a case study format to reinforce learning.

Rounding out this detailed discussion, Part Six discusses behavioral aspects of portfolio implementation including behavioral finance aspects of the active/passive debate, behaviorally aware portfolio construction, and behavioral finance and market corrections. An explanation of the coronavirus bear market finishes Part Six including.

Updated to reflect current market conditions, this reliable resource skillfully illustrates investors' behavioral biases in detail and offers investors practical advice about how to apply the science of behavioral finance to improve overall investment decision making.