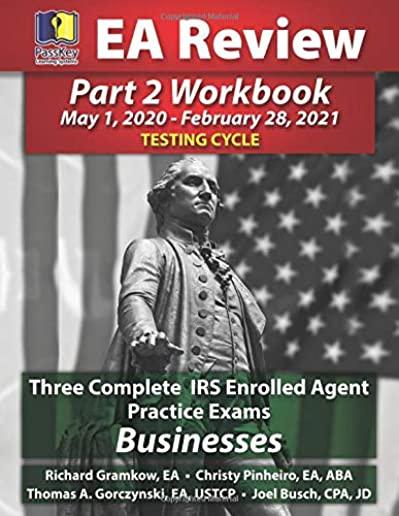

Busch, Joel

The PassKey Learning Systems Workbook for Part 2, Businesses, features three complete Enrolled Agent practice exams, with detailed answers, to accompany the PassKey study guide for Businesses. The three hundred targeted test questions have been created specifically for the EA exam cycle that runs from May 1, 2020, to February 28, 2021.

This year's edition includes the sweeping, last-minute tax law changes of the Consolidated Appropriations Act of 2020, which was signed into law on December 20, 2019. This bill included a host of tax provisions, extenders, and retirement plan changes. The Act extends thirty-four tax provisions that either had already expired or that were scheduled to expire.

Using this workbook, you can challenge yourself by taking three full practice exams for the Businesses section of the EA exam. The test questions are different from the ones in the PassKey study guides so you can experience a more true-to-life exam experience.

All of the answers are clearly explained in the answer section. If you answer a question incorrectly, you will understand why it was incorrect and learn the concepts needed to pass the EA exam. The PassKey EA Review workbooks have been rigorously vetted for accuracy by experts in the tax profession. Test yourself, time yourself, and learn

member goods

listens & views

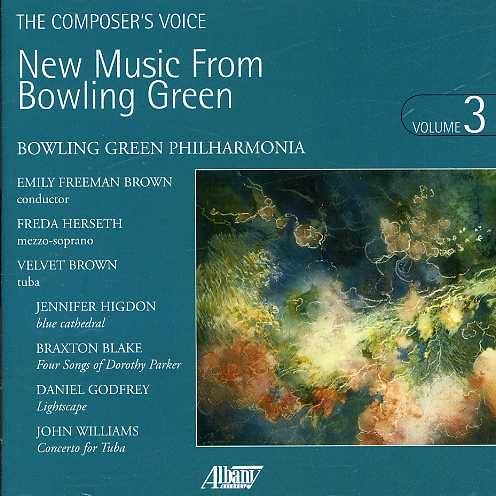

TUBA CONCERTO: NEW MUSIC FROM ...

by WILLIAMS / HIGDON / BLAKE / HERSETH / BROWN

COMPACT DISCout of stock

$14.75